Additional terms and restrictions apply SeeFree In-person Audit Supportfor complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return. H&R Block employees, including Tax Professionals, are excluded from participating.

#2020 tax tables 1040 nr how to

Where’s My Refund? How To Check The Status Of My Tax Return Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. The only thing you can really do wrong is to ignore it or run from it. It’s a correction process that’s there to help you amend an error. File a 1040X Amended form as soon as possible to correct the error. If they bring an error to you attention, just correct it and follow it through. The IRS will pursue you if anything on your return seems fraudulent.

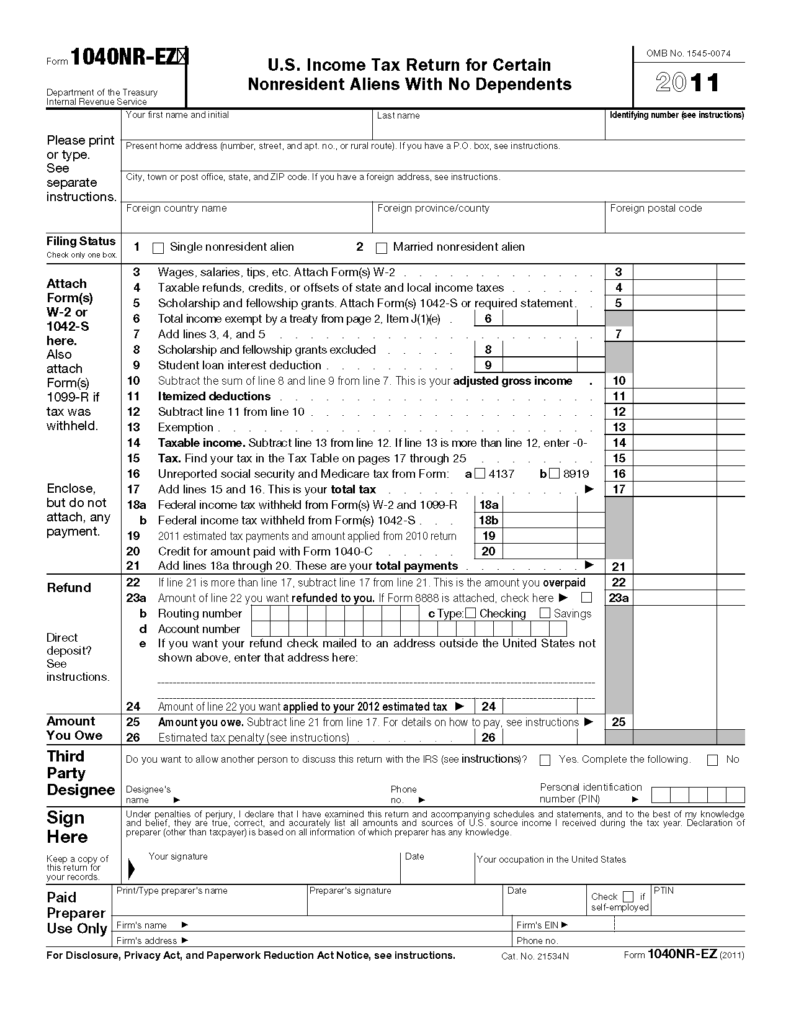

Most filers will need to enter information from at least one W-2, if not several.You will also need to attach a copy of your W-2s to your return.įorm 1040-SR can be filed electronically, just as Form 1040 can. This will include income from wages, salaries, and tips, as well as other income included on a W-2 by your employer. Enter income included on your W-2 forms on line 7.

Contact a CPA, tax attorney, or IRS enrolled agent for more information on itemizing your deductions when the standard deduction is greater. While there are a limited number of circumstances in which a person would want to itemize deductions, even if the standard deduction is greater, most filers should take whichever deduction is greater. Most filers’ standard deduction can be found on form 1040 in the box to the left of line 40.Compare the amount on line 39 of Schedule A with your standard deduction. Print Federal Income Tax Forms And Instructions Booklet From List (irs).Where’s My Refund? How To Check The Status Of My Tax Return.

0 kommentar(er)

0 kommentar(er)